SafetyWing Remote Health Review

Remote Health for Remote Workers and Nomads is SafetyWing’s newest insurance product catering to anyone in need of a robust, reliable medical plan both in their home country and while abroad. It provides $1,000,000 in emergency medical coverage, covers pre-existing conditions and hospital visits anywhere in the world, and even provides coverage for COVID-19.

If you’re an expat living abroad, or someone who spends several months of the year in your home country and several months internationally, Remote Health for Remote Workers and Nomads could be a great fit for you.

Learn more about Remote Health today.

What Is SafetyWing?

The brainchild of three Norwegians, SafetyWing provides a modern take on travel and medical insurance. Based between Oslo and Silicon Valley, they’re building a global safety net for online freelancers, entrepreneurs, digital nomads, and frequent travelers.

Their flagship product, Nomad Insurance, was designed specifically for travelers and nomads. But now, with the advent of Remote Health for Remote Workers and Nomads, SafetyWing has expanded its reach to an even wider audience encompassing less frequent travelers, expats living abroad, and more.

Save 39% on Temu & 1000+ more stores

- Open a TopCashback account (works worldwide).

- Receive your $15 signup bonus.

- Save 39% on Temu and 1000+ other stores.

In this post, we’ll compare Remote Health with its two biggest competitors—World Nomads and SafetyWing’s own Nomad Insurance—to see which is the best fit for you.

Who Is Each Plan For?

Remote Health for Remote Workers and Nomads

Remote Health is a catch-all insurance policy that works well for anyone in need of health care while living in their home country, expats living abroad, and long-term travelers. It’s especially useful if you find yourself straddling several of those categories: perhaps you travel abroad each winter and spend your summers at home, or maybe you split your time between two or more countries every year.

Most other insurance providers only cover you whether you’re at home OR when you’re abroad, so having coverage for both with the same plan is a big perk. Remote Health does not provide coverage for Americans and Canadians living in their home country.

Nomad Insurance

Nomad Insurance caters to a smaller subsection of those who could use Remote Health: frequent travelers. If you’re a digital nomad who spends most of your time away from home, Nomad Insurance is likely the right option for you. It allows for 30 days of home country coverage out of every 90 days (or 15 days per 90 days if you’re American), so you can still visit home whenever you want.

World Nomads

World Nomads, like Nomad Insurance, is designed for travelers. However, World Nomads doesn’t offer any home country coverage, so it’s only useful while you’re on the road, and won’t cover you when you pop back home.

Coverage

Remote Health For Remote Workers and Nomads

Remote Health is one of the very few insurance policies available for both remote workers and regular folks alike. It provides significantly broader coverage than either of Nomad Insurance and World Nomads, which is why it’s positioned as a policy for all of your health and medical needs, not just emergency care while you travel. Remote Health offers coverage at any public or private hospital in the world.

Remote Health comprehensive coverage includes:

| Coverage Type | Coverage Limit |

| Hospital charges, medical practitioners and specialist fees: Charges for in-patient or day-patient treatment made by a hospital, including charges for accommodation. This also includes prescribed drugs and dressings. | Full refund |

| Diagnostic Procedures: Medically necessary diagnostic procedures like MRIs, PETs, and CT scans. | $5,000 |

| Renal Failure and Dialysis: Treatment of renal failure, including renal dialysis. | $20,000 |

| Organ Transplant: Treatment for organ transplants like kidney, pancreas, or bone marrow (not including costs associated with the donor). | $150,000 |

| Cancer: Treatment for cancer including oncologist fees, surgery, chemotherapy etc. | Full refund |

| Newborns: Hospital treatment of premature or acute condition newborns within 30 days of birth. | $50,000 |

| Pandemics: Including COVID-19 | Full refund |

| Congenital Disorders | $25,000 |

| Reconstructive Surgeries | Full refund |

| Hospital or Out-Patient Surgeries | $500,000 |

| Emergency Dental Treatment: Treatment required to natural teeth following an accident that necessitates your admission to a hospital for at least one night. | $500,000 |

| Rehabilitation: Rehab when referred by a specialist and part of Treatment for a condition necessitating admission to a recognized rehab unit of a hospital. Coverage includes things like physical therapy and occupational therapy fees, etc. | $500,000 |

| Emergency Ambulance Transportation | Full refund |

| Evacuation: Arrangements to move you to the nearest medical facility when you’re in life-threatening condition. | $100,000 |

| Repatriation: Economy airfare to return you and an accompanying person to your home country. | Full refund |

| Hospital Cash Benefit: Cash payable to you if you stay in the hospital overnight in your country of residence. | $3,750 |

| Annual Maximum | $1,000,000 per year |

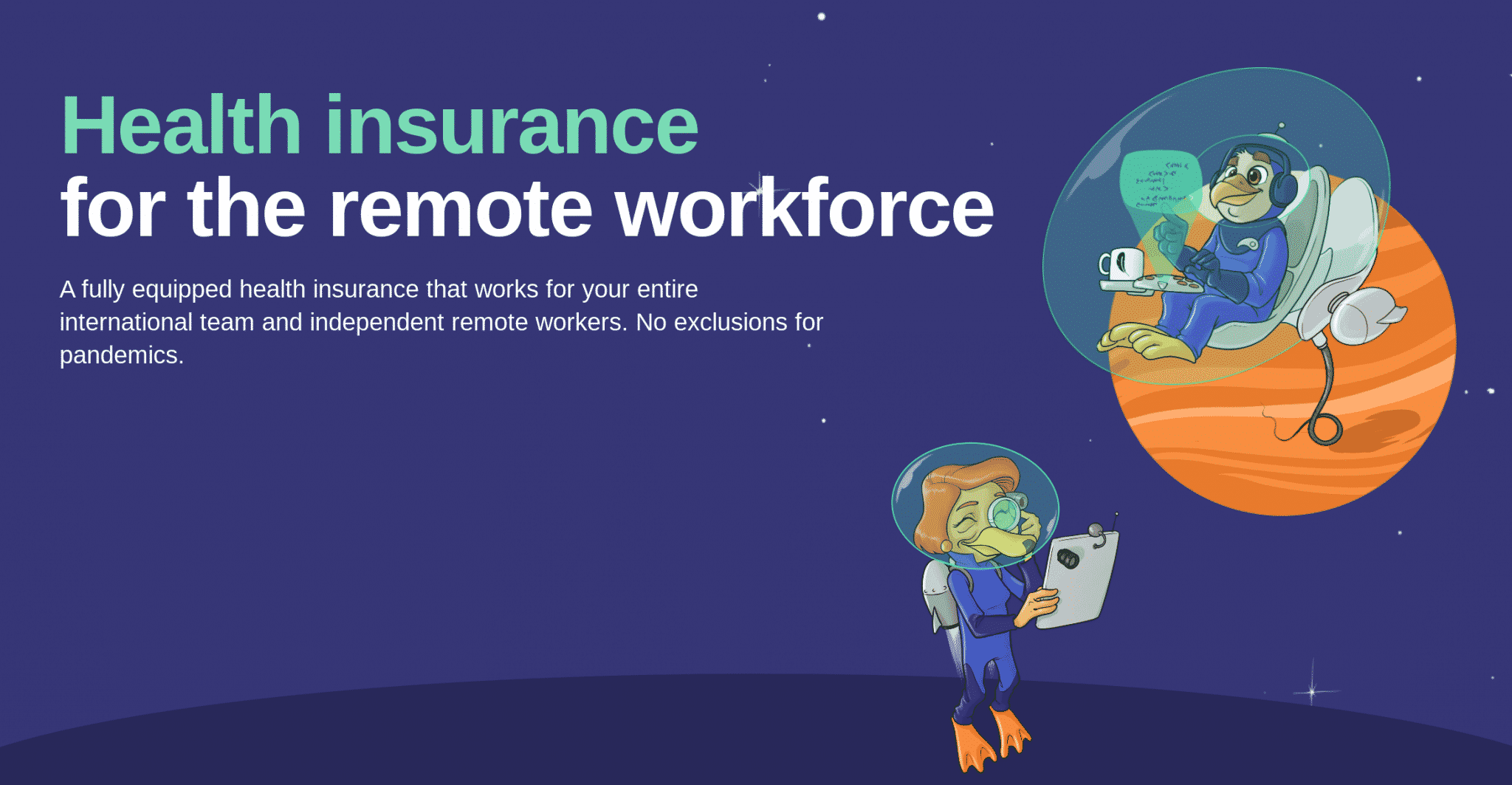

You can also tailor your Remote Health plan by selecting a handful of different add-ons. Here are four of the add-ons Remote Health offers:

- Dental Care: Coverage of up to $1,500 when you need to see a dentist for routine care such as check-ups, fillings, etc., or more complex care like repairing or receiving new crowns, dentures, or inlays. (Note: You must be at least 9 months into your policy to receive coverage for dental care.)

- US, Hong Kong & Singapore: Remote Health generally only provides 30 days of coverage per year in these countries. This add-on boosts that to 6 months of coverage per year.

- Outpatient Care: Get covered for medical visits outside of the hospital such as your family doctor, physiotherapy etc. There’s a 10% co-pay attached to this add-on, which means that if your appointment costs $150, you’ll pay $15 and be reimbursed $135.

- Maternity Care: Covers routine check-ups, scans, and delivery costs during pregnancy. This benefit covers up to $5,000 with a co-pay of 20%. (Note: You must be at least 12 months into your policy to receive coverage for maternity care.)

Nomad Insurance

Nomad Insurance covers travelers all over the world (except for North Korea, Cuba and Iran) while they’re outside of their home country. It also offers 30 days of home country coverage per every 90 days (15 days of home country coverage per every 90 days if you’re American), making it a great fit for travelers and digital nomads who spend most of their time abroad with the occasional visit back home.

Nomad Insurance coverage includes:

| Coverage Type | Coverage Limit |

| Emergency Room Visit | Full Refund |

| Urgent Care Center | Full Refund |

| Emergency Dental | $1,000 |

| Acute Onset of Pre-Existing Condition | Full Refund |

| Terrorism | $50,000 |

| Emergency Medical Expenses | Full Refund |

| Emergency Medical Evacuation | $100,000 |

| Trip Interruption | $5,000 |

| Lost Checked Luggage | $3,000 ($500 per item) |

| Personal Liability | $10,000 |

| Annual Maximum | $250,000 per year |

World Nomads

World Nomads offers two policies: their Standard plan, which provides basic coverage, and their Explorer plan, which offers more robust coverage. We’ll focus on their Explorer plan in this post. World Nomads also provides slightly different levels of coverage depending on your nationality, so this is what the World Nomads Explorer plan covers for Americans:

| Coverage Type | Coverage Limit |

| Emergency Accident & Sickness Medical Expense | $100,000 |

| Emergency Evacuation | $500,000 |

| Repatriation of Remains | $500,000 |

| Non-Medical Emergency Transportation | $25,000 |

| Trip Cancellation | $10,000 |

| Trip Interruption | $10,000 |

| Trip Delay | $1,500 |

| Baggage & Personal Effects | $3,000 |

| Baggage Delay (outward journey only) | $750 |

| Rental Car Damage – where permissible | $35,000 |

| Accidental Death & Dismemberment | $10,000 |

| Generali Global Assistance 24-Hour Assistance Services | Unlimited |

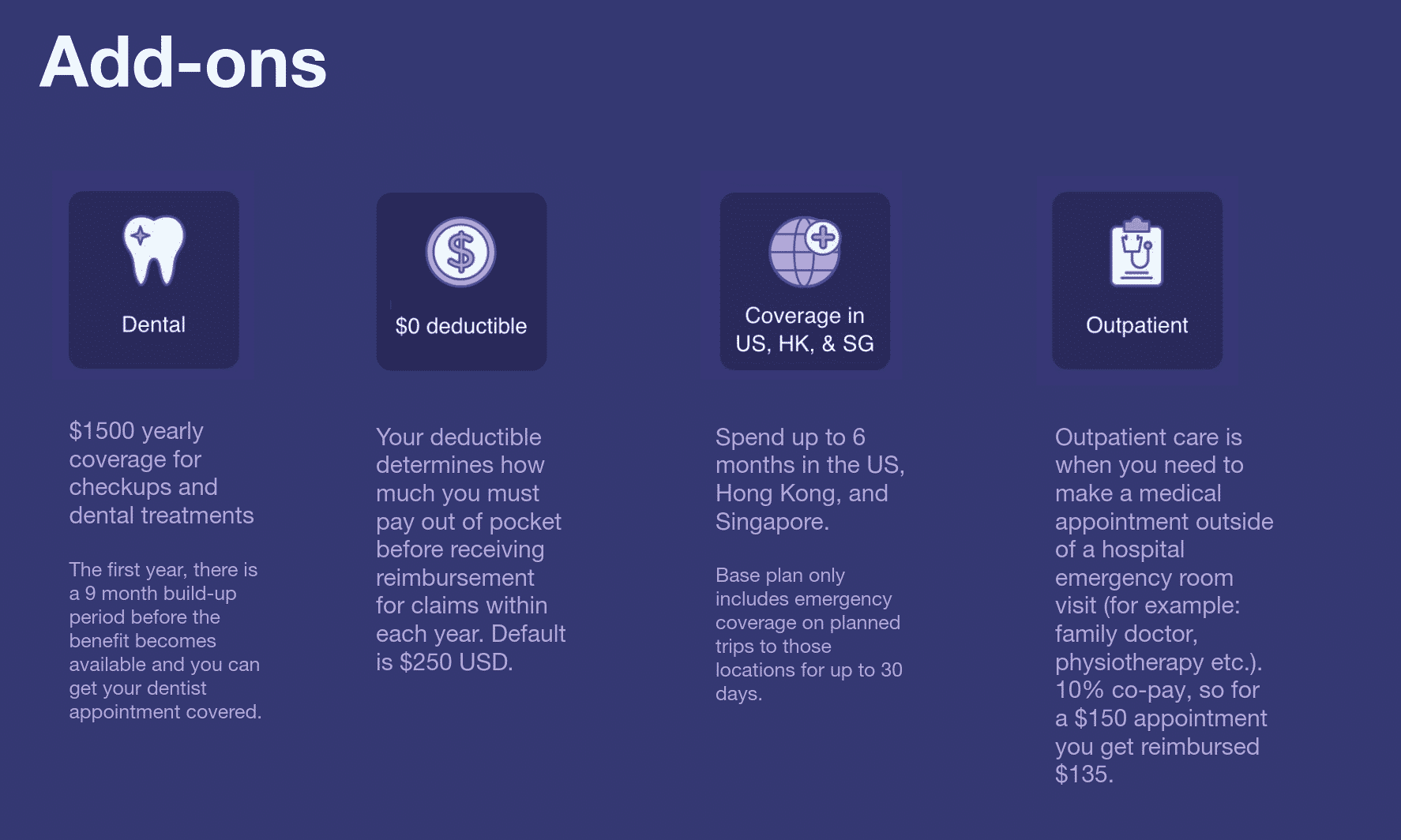

Remote Health for Remote Workers and Nomads vs. Nomad Insurance vs. World Nomads

Now we’ll compare the highlights of each plan for a 35-year-old policyholder. For a more detailed look at the coverage each plan provides, refer to the Coverage section above or click on the link to their policy at the bottom of this table.

| Remote Health for Remote Workers and Nomads | Nomad Insurance | World Nomads Explorer | |

| Monthly Cost | $153 | $37 | $209 |

| Emergency Medical | $1,000,000 | $250,000 | $100,000 |

| Trip Cancellation | No | No | $10,000 |

| Emergency Dental | $1,500 | $1,000 | $750 |

| Trip Interruption | No | $5,000 | $10,000 |

| Lost Baggage | No | $3,000 | $3,000 |

| Personal Liability Coverage | No | $10,000 | No |

| Home Country Coverage | Yes | 30 days out of every 90 days (15 days out of every 90 days for Americans) | No |

| Coverage Area | Worldwide | Worldwide excluding North Korea, Cuba and Iran | Worldwide excluding North Korea, Cuba, Iran, Crimea and Syria |

| COVID-19 Coverage | Yes | No | No |

| Link to Policy | Here | Here | Here |

Remote Health for Remote Workers and Nomads’ Stance on COVID-19

Unlike most of the big insurance providers, Remote Health does not exclude pandemics, including COVID-19, from its coverage. Here’s the level of coverage you can expect with Remote Health if you contract coronavirus:

- Treatment: Remote Health has no exclusion on pandemics, so treatment of coronavirus in a hospital is covered.

- Isolation: Remote Health covers treatment in an isolation ward if deemed necessary by your doctor.

- Hospital Cash Benefit: If you stay in a free-of-charge hospital (example: a public hospital in your home country), you’re eligible for a cash payout of up to $125 per night for up to 30 nights.

- Claims: Extra fast turnaround times for treatment pre-authorizations and claims for members diagnosed with COVID-19.

Our Recommendation

Overall, Remote Health for Remote Workers and Nomads is a significantly more comprehensive medical plan than Nomad Insurance or World Nomads. It’s an excellent fit for anyone spending extended periods of time in multiple countries, or someone looking for all-encompassing coverage in their home country. With a $1 million annual limit and generous coverage across a wide variety of ailments and mishaps, we highly recommend Remote Health for Remote Workers and Nomads.